Technology giant Apple has managed to break out of its yearlong slump in sales, thanks in part to strong demand for its latest iPhone model and continued growth in its services division. However, as the company faces legal threats and struggles to regain its position as the most valuable publicly traded company in the United States, doubts remain about its long-term growth prospects. This article will delve into Apple’s recent financial performance, the challenges it currently faces, and its strategies for the future.

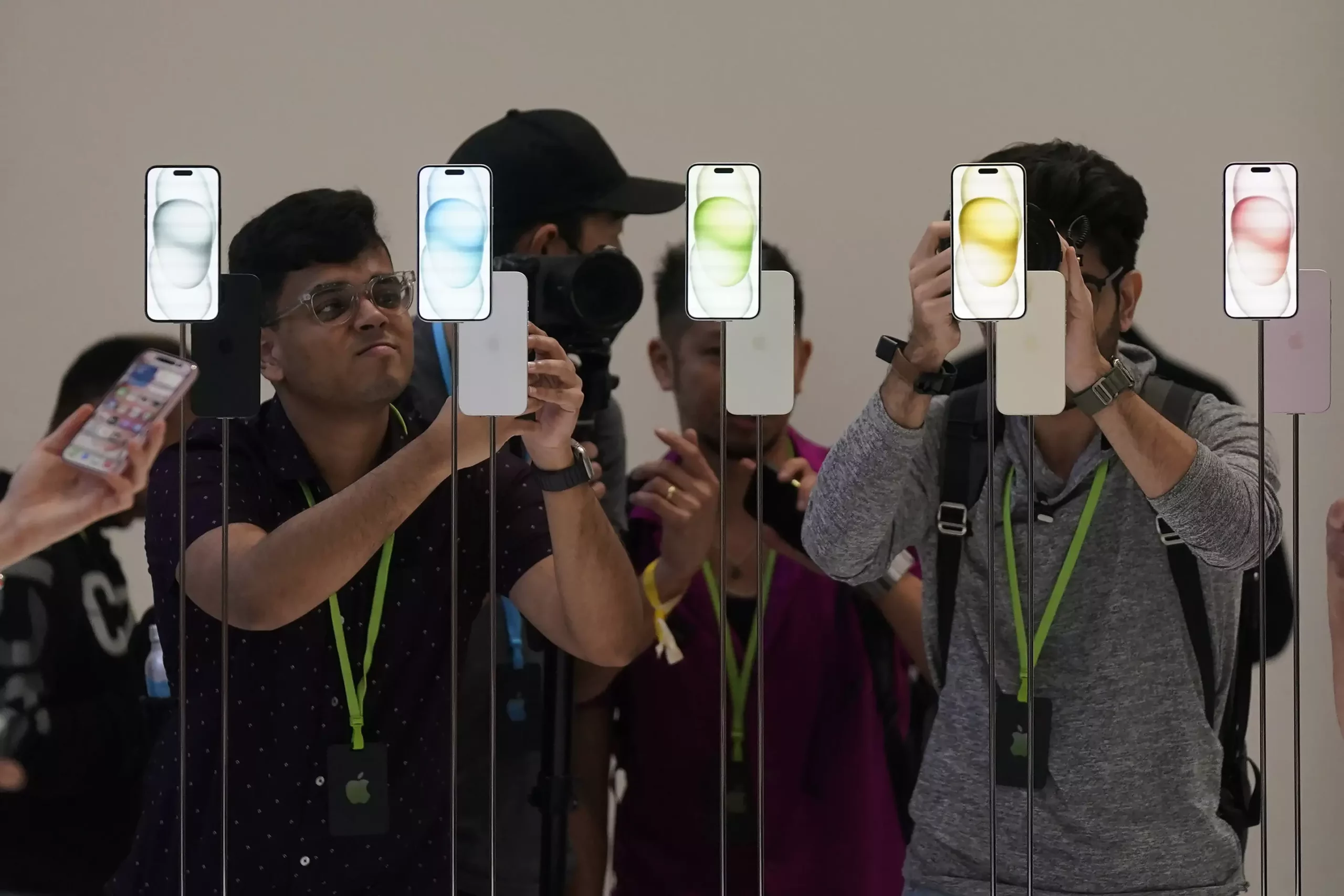

Apple’s revenue for the October-December quarter saw a modest 2% increase from the previous year, reaching $119.58 billion. The company also reported earnings of $33.92 billion, marking a 13% gain compared to the same period last year. Unsurprisingly, the iPhone continues to be Apple’s flagship product, accounting for the majority of its revenue. Sales of iPhones in the past quarter totaled $69.7 billion, a 6% increase from the previous year.

Apple’s services division, closely tied to the iPhone, experienced an 11% rise in revenue, reaching $23.12 billion. While this growth is encouraging, the division is currently facing legal challenges that may impact its future prospects. One such challenge involves a search deal with Google, estimated to bring in $15 to $20 billion annually, which is now the focal point of an antitrust case brought by the U.S. Justice Department. Additionally, regulatory rules in Europe and a lawsuit by video game maker Epic Games have forced Apple to revise its commission system in the iPhone app store. Critics argue that these concessions are insufficient and advocate for more significant changes.

For years, Apple held the position of the most valuable publicly traded company in the U.S., but this title has since been claimed by Microsoft. The shift in market dynamics can be attributed, in part, to Microsoft’s early leadership in artificial intelligence technology. Apple hopes to reclaim its status with the release of the Vision Pro headset, a device that promises to transport users into a hybrid of physical and digital environments. However, the headset’s hefty price tag of $3,500 is expected to limit consumer demand, at least in the initial stages.

Uncertain Future Growth

Although Apple’s recent financial results have exceeded analysts’ expectations, concerns persist about its ability to sustain long-term growth. The company’s lukewarm forecast for the January-March period indicates a decline in iPhone sales from the previous year. This has further contributed to a decline in Apple’s stock price, with a potential loss of nearly $200 billion (6% of market value) so far this year if the trend continues.

Another significant challenge for Apple emerges from China, a crucial market that has experienced a decline in iPhone sales due to the country’s weakening economy. Additionally, there are reports of a potential government restriction on employees purchasing iPhones. In the past quarter, Apple’s revenue in China saw a 13% drop from the previous year, reaching $20.82 billion.

Apple may have achieved a respite from its sales decline, but the company’s future growth remains uncertain. With mounting legal challenges and the loss of its top position in the stock market, Apple faces an uphill battle to regain its dominance. However, the tech giant’s commitment to innovation and its upcoming spatial computing device, the Vision Pro headset, offer glimmers of hope. As Apple continues to navigate obstacles and adapt to an ever-changing market, only time will reveal whether it can reclaim its former glory.

Leave a Reply