Intel’s recent financial report presents a complex picture: on the surface, the company surpasses expectations with better-than-anticipated revenue and a buoyant outlook for the upcoming quarter. Yet, beneath this veneer of quarterly success lies a significant storm—a 9% plunge in their stock price triggered by a troubling strategic shift. This stark contradiction underscores a fundamental tension in Intel’s current trajectory: the challenge of balancing short-term financial performance with long-term strategic stability. Despite beating earnings estimates, investors reacted sharply to the company’s announcement of drastic cost-cutting measures and the uncertain future of its foundry business, revealing deep-seated doubts about Intel’s ability to reposition itself effectively in a fiercely competitive market.

Strategic Missteps and Leadership Woes

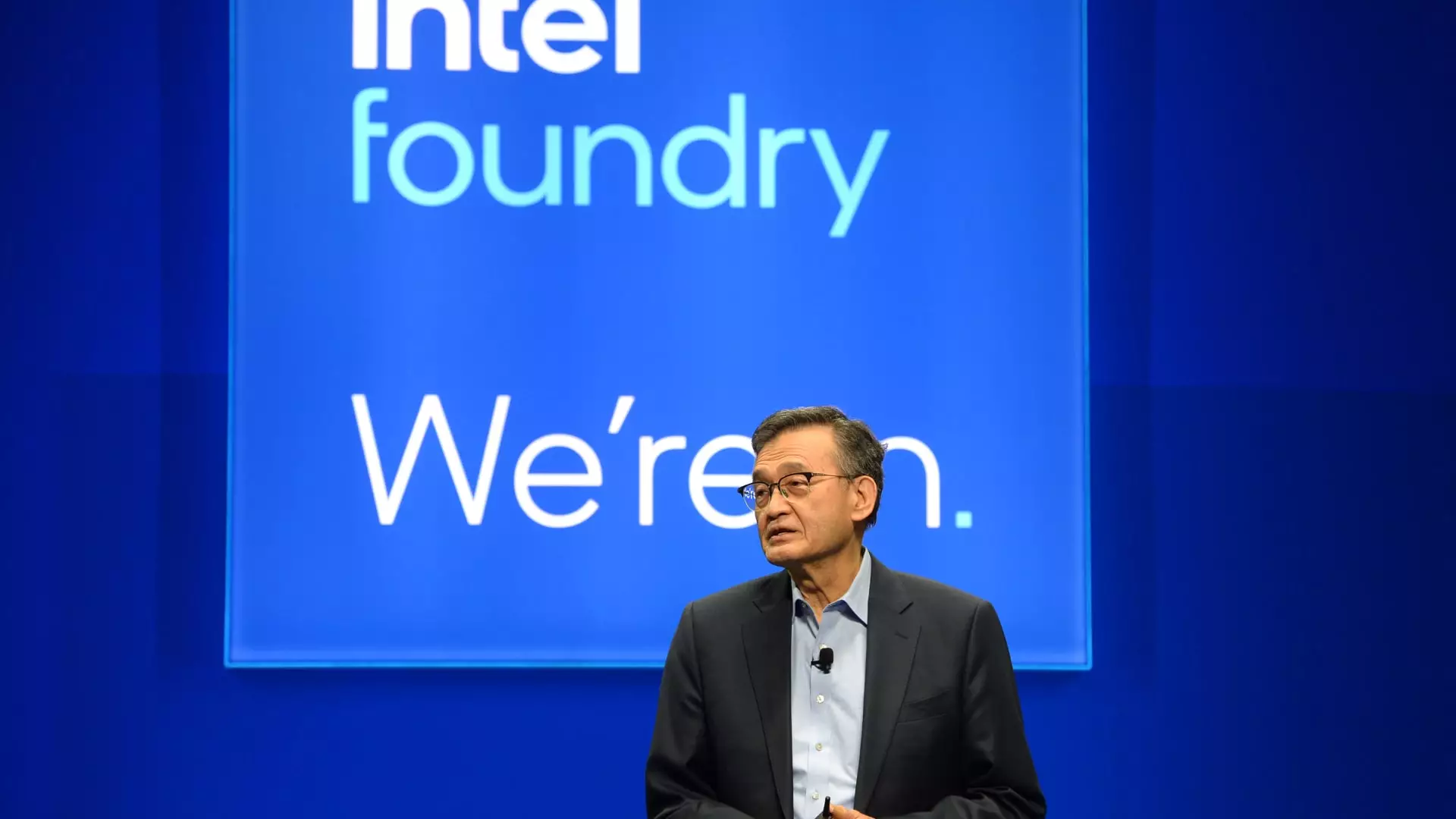

The leadership under CEO Lip-Bu Tan faces an arduous path forward. Appointed during a period of intense difficulty, Tan inherited a legacy of overcapitalization and strategic misjudgments. His acknowledgement that “most of the investments were too much, too soon” hints at fundamental miscalculations. Intel historically bet on expanding its manufacturing capacity to dominate the global chip market, but the results have been underwhelming, leaving the company’s factory footprint fragmented and underutilized. The decision to cut back investments in Europe—specifically in Germany and Poland—and slow production at the Ohio plant demonstrates an acknowledgment of these miscalculations, yet it also signals a retreat that could further damage Intel’s competitiveness in the high-stakes foundry arena.

The Crane of Uncertainty in Foundry Business

Central to Intel’s latest dilemma is its struggling foundry division—a segment few believe will recover easily. The company’s admission that it might “pause or discontinue” its foundry operations if external customer commitments aren’t secured reveals an unsettling dependency on external clients. Their failure to attract significant third-party customers for their new 14A process technology casts a long shadow, raising questions about the viability of Intel’s once-ambitious foundry ambitions. Analysts have expressed cautious optimism, viewing the cutbacks as a prudent move; however, skepticism persists about whether Intel can carve out a sustainable niche when the market’s most lucrative orders are flowing to competitors like TSMC and Samsung.

Market Perception and the Reality of Decline

The market’s brutal reaction—the loss of 60% of Intel’s stock value in 2024—reflects broader doubts about the company’s future. The decline signifies more than just investor jitters; it emphasizes the erosion of confidence in Intel’s ability to compete effectively across key segments, including artificial intelligence, where Nvidia reigns supreme. The company’s failure to capture meaningful AI market share is a glaring shortcoming that compounds concerns about its overall innovation capacity. Moreover, the widening net losses and impairments listed in their earnings reveal deeper financial wounds—$2.9 billion in net loss and an $800 million impairment charge—that paint a picture of a company hemorrhaging resources without clear strategic breathing room.

Leadership’s Reckoning and the Road Ahead

Tan’s candid reflections about the difficult first months as CEO signal a leadership determined to recalibrate, even if the path remains uncertain. The layoffs—eliminating a significant portion of the workforce—serve as a stark acknowledgment that reducing costs is unavoidable. Yet, such cuts risk further erosion of innovation momentum and organizational morale. The challenge is to transform these austerity measures into a foundation for a more sustainable core business that can adapt to rapid technological shifts. If Intel fails to shift from its heavy investments on “faith,” the company’s future will remain opaque, vulnerable to obsolescence in an industry where speed, innovation, and strategic agility are vital.

Intel stands at a pivotal crossroads, facing the daunting task of restructuring itself amid shrinking market share and mounting financial pressures. Its strategy of pulling back from the foundry expansion—a core pillar of its previous ambitions—might be the last chance for a strategic reset. The real test lies in whether Intel can leverage its existing assets, reinvent its manufacturing capabilities, and carve out a meaningful position in AI and other high-growth segments. Without bold, innovative leadership and a crystal-clear vision, the company risks fading further into the background of the global semiconductor landscape—a fate that would be difficult to reverse in such a competitive field. While the road ahead is fraught with peril, there remains an opportunity for Intel to reinvent itself as a leaner, more focused player capable of weathering industry upheavals and emerging stronger on the other side.

Leave a Reply