In a surprising move, President Donald Trump has decided to roll back tariffs on electronics, a change that signals both an acknowledgment of the ongoing volatility in the stock market and the influence of the tech industry lobby. Just recently, the U.S. Customs and Border Protection released a document confirming that consumer electronics, primarily manufactured in China, will be exempt from hefty tariffs that reached as high as 145%. Tariffs on semiconductors, crucial components found in an array of devices, have also been lifted. This shift illustrates a strategic realignment towards a more tech-friendly economic policy, as the repercussions of imposing steep tariffs could severely disrupt the lifeblood of the modern U.S. economy.

Amidst the backdrop of a stock market that has declined by 15% since the beginning of Trump’s presidency, this exemption is seen as a potential lifeline for investors and economic stakeholders alike. However, questions linger about how effective this move will be in restoring consumer and investor confidence. The erratic nature of Trump’s trade policies may cast a long shadow over any optimistic projections, leaving many to speculate whether his administration can sustain a consistent approach that fosters growth.

The Economic Ramifications of Tariffs on Consumer Electronics

One significant concern tied to these tariffs is the economic impact on consumer electronics. Prior to the reversal, analysts speculated that the introduction of tariffs might cause the price of a $1,000 iPhone to skyrocket to an untenable $3,500. Although these figures may be exaggerated, the reality remains that tariffs would indeed constrain consumer purchasing power. The Consumer Technology Association indicates that the price of gaming consoles could see a staggering 40% increase, smartphones could be 26% more expensive, and laptops might jump by as much as 46%. Such drastic fluctuations threaten to alienate consumers and push them away from domestic markets.

It’s essential to contextualize these changes within broader technological trends. The U.S. once captured a significant portion of the global chip market, but over decades, competitors like Taiwan’s TSMC have risen to prominence, diminishing U.S. market share. This erosion was not merely a side effect of globalization; it reflects longstanding structural weaknesses in American tech manufacturing. Therefore, while lifting tariffs might provide immediate relief for consumers, it does little in the long run to address the fundamental issues of domestic production and technological innovation.

The Long Road Ahead: Rebuilding Chip Manufacturing in the U.S.

Despite Trump’s claims that the U.S. will regain its status as a manufacturing powerhouse for critical technologies, the reality is complex. While companies like Apple have committed to increasing U.S. production, the process of reestablishing a robust semiconductor manufacturing base is fraught with challenges. Industry experts like Duncan Stewart from Deloitte emphasize that even with substantial financial backing, the U.S. chip manufacturing sector will likely take decades to catch up to global leaders. With projections suggesting a mere increase from 10% to 14% market share by 2032, this is a slow process and indicative of the hurdles facing American manufacturers.

The Trump administration’s strategy has focused on bringing manufacturing jobs back, but the reality is that relocating lost manufacturing capabilities isn’t as simple as flipping a switch. Smart policy requires comprehensive support structures, such as subsidies and educational initiatives to bolster the workforce. As technology evolves, companies need not only factories but also skilled workers – a requirement that the U.S. is struggling to fulfill, particularly as countries like China produce far more engineers and specialists due to their robust education systems.

The Broader Implications for Employment and Innovation

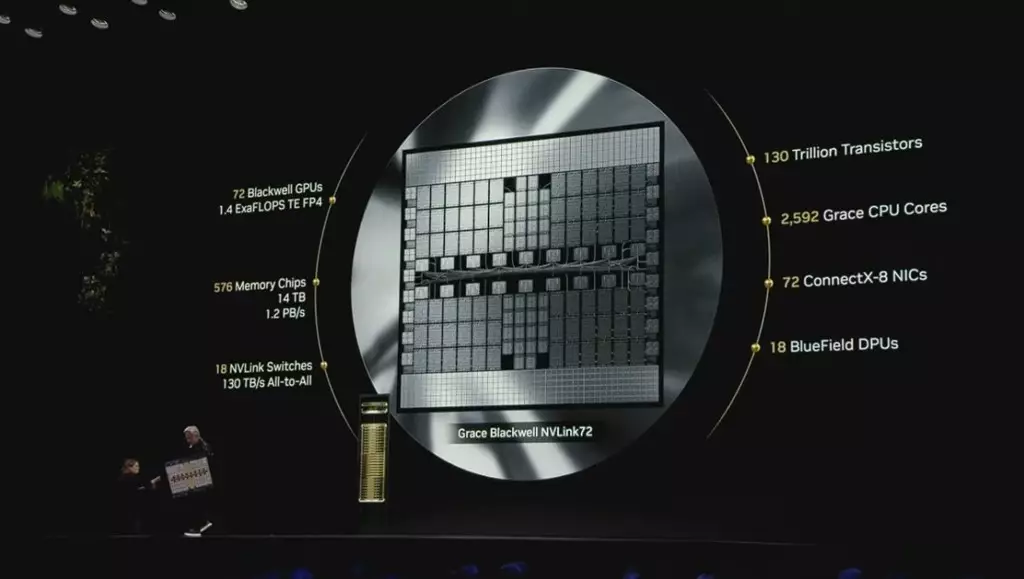

The tech industry plays a pivotal role in modern economies, providing high-value jobs that require advanced education and specialized skills. As firms like Nvidia leapfrog competition through innovative practices, such as utilizing advanced manufacturing processes to support cutting-edge applications like artificial intelligence, it becomes evident that job creation in tech cannot rely solely on domestic production. Policymakers must grapple with the importance of not just manufacturing jobs, but also building a workforce equipped with the skills needed for an evolving industry landscape.

Critics may decry the influence of tech lobbyists on the administration’s trade policies, yet it’s hard to dispute the necessity of fostering a vibrant tech sector. The industry is vital not just for immediate profits but for long-term economic sustainability. Thus, while tariffs and trade strategies hold importance, they must be viewed as part of a broader, integrated approach to revitalize American manufacturing and education alike.

With the Trump administration declaring the urgency of reducing reliance on foreign manufacturing, it’s apparent that tariffs are only one component of a more elaborate strategy. Whether relying on political rhetoric or tangible outcomes, the real test lies in the ability to overhaul the U.S. tech landscape and reclaim its standing as a leader in innovation and job creation.

Leave a Reply