In a stark forecast for consumers, Acer’s CEO Jason Chen recently announced that laptops in the United States could see a price hike of around 10 percent starting next month. Chen attributes this increase directly to the 10 percent import tax imposed by the Trump administration on goods from China. This economic maneuver, designed to bolster domestic production, has led companies to reassess their pricing strategies as they navigate the complexities of international tariffs.

While Acer is openly adjusting its prices, Chen hints at a more concerning trend in the industry: potential price gouging by competitors. He suggests that other companies may take advantage of the tariff situation, raising prices beyond the expected 10 percent if they believe customers are willing to pay more. This raises a significant ethical consideration within the tech industry, where the line between necessary price adjustments and opportunistic price hikes can often blur. As consumers brace for higher costs, the integrity of rival firms will be put to the test.

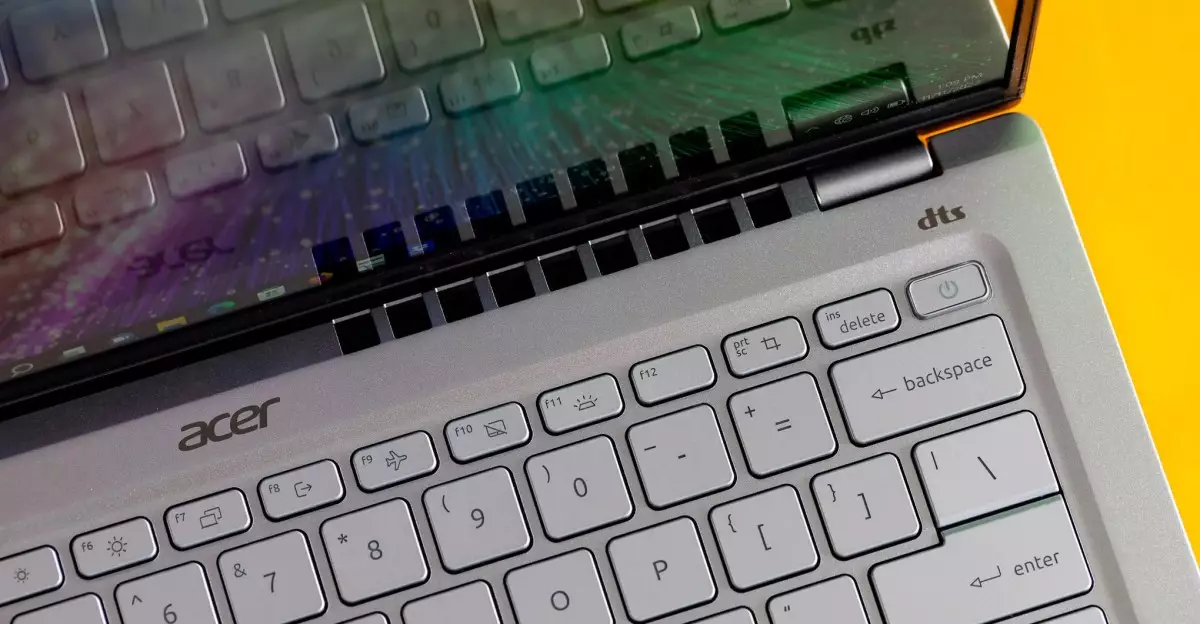

Interestingly, Acer has been proactive in response to previous tariffs, opting to shift some of its desktop manufacturing out of China. Chen notes that the majority of laptop production still takes place in China, which complicates the price-setting process for many tech giants, including industry staples like Apple, Dell, and HP. These companies depend on Chinese manufacturers; thus, any shifts in tariffs force them to reconsider not just pricing but also their entire supply chain dynamics.

The reactions from other manufacturers to Acer’s pricing strategy remain largely speculative. So far, major players such as Apple and Lenovo have not publicly commented on whether they will match or vary from Acer’s price increases. This silence underscores an essential tension in the tech market: while some companies may seek to maintain lower prices to remain competitive during turbulent economic conditions, others may seize the moment for profit maximization. It will be fascinating to observe how this situation unfolds as companies weigh consumer loyalty against short-term profitability.

Some smaller companies, like Framework, are already responding strategically to these economic pressures. Framework’s CEO, Nirav Patel, mentioned that while their modular laptop pricing remains mostly unaffected due to manufacturing decisions in Taiwan, they are preparing for potential impacts on specific parts produced in China. This reflects a growing trend among tech firms to diversify their supply chains as a buffer against future tariffs and global market fluctuations. By diversifying production locations, companies can mitigate risks and maintain more stable pricing for consumers.

As the landscape changes with the announcement of pricing shifts, consumers are left to ponder what this means for their purchasing decisions. If multiple manufacturers begin to raise prices, customers might be forced to weigh the value proposition of purchasing new devices against potential financial strain. The interplay of tariffs, competitive pricing, and manufacturing strategies will undoubtedly shape the future of the laptop market, leaving consumers and companies alike to navigate these uncharted waters.

Leave a Reply