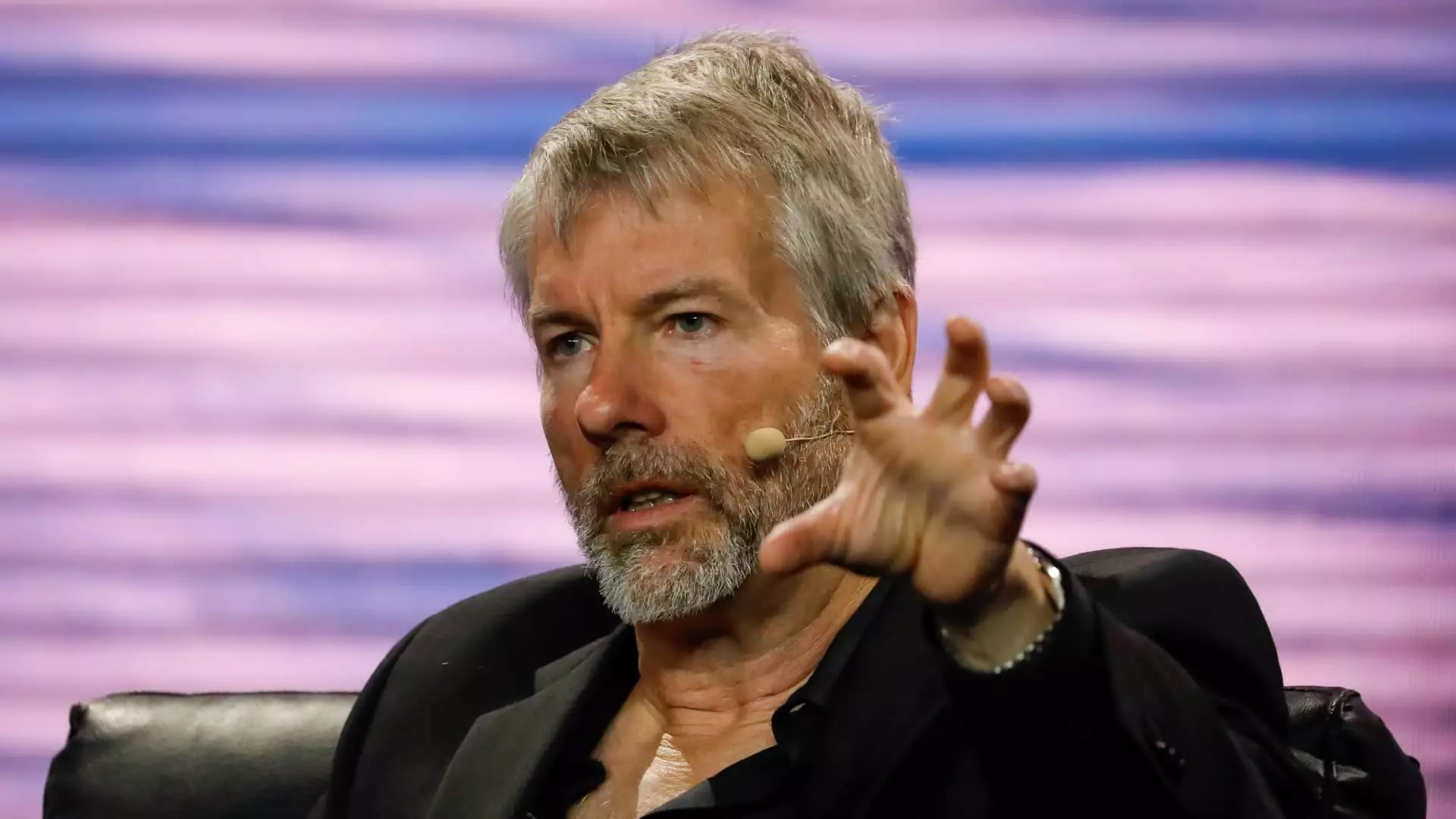

Michael Saylor, the CEO of MicroStrategy, has been on a buying spree when it comes to Bitcoin. His recent announcement of purchasing another 12,000 Bitcoins for $822 million sent shockwaves through the market. This brings MicroStrategy’s total Bitcoin holdings to a staggering 205,000, valued at over $15 billion. The company’s shares have been closely tied to Bitcoin’s performance, with every mention of Bitcoin by Saylor causing a surge in MicroStrategy’s stock price.

MicroStrategy, primarily a software development company, has transformed into a major player in the cryptocurrency market due to its massive Bitcoin holdings. The company’s stock has been on a rollercoaster ride, climbing 11% on Wednesday alone. This surge follows a series of gains in the stock price, with MicroStrategy’s value skyrocketing by 180% this year. The company’s stock value is appreciating at a much faster rate than the Bitcoin it’s acquiring, showcasing the impact of their investment strategy.

Saylor’s bullish outlook on Bitcoin is evident in his recent interviews, where he predicts that Bitcoin will overshadow gold as the premier store of value. He anticipates a wave of institutional investors rushing to own the digital asset, especially with the possibility of Bitcoin being added to exchange-traded funds. Saylor is also optimistic about Bitcoin’s upcoming halving process, which reduces the coin supply and increases demand, ultimately driving the price higher.

MicroStrategy recently completed an offering of 0.625% convertible notes, raising approximately $782 million in net proceeds. The company strategically used these funds to acquire more Bitcoin, further increasing its holdings. This move marked a shift from previous funding methods, as MicroStrategy opted to leverage its capital structure by issuing convertible notes instead of relying solely on equity financing. The company’s innovative approach to financing its Bitcoin purchases reflects its commitment to maximizing shareholder value.

The Rise of MicroStrategy: A Bitcoin Success Story

MicroStrategy’s foray into Bitcoin started in mid-2020 when the company unveiled its plan to invest $250 million in alternative assets, including digital currencies like Bitcoin. This initial investment has since ballooned into a multi-billion dollar portfolio, propelling MicroStrategy’s market cap to an impressive $30 billion. The company’s remarkable transformation from a software firm to a major Bitcoin player highlights the potential rewards of bold investment strategies in the volatile cryptocurrency market.

MicroStrategy’s aggressive Bitcoin investment strategy has paid off handsomely, with the company’s stock price surging alongside its growing Bitcoin holdings. While critics may question the sustainability of this approach, MicroStrategy’s success story serves as a testament to the potential rewards of embracing innovative investment opportunities. As Bitcoin continues to dominate the financial landscape, MicroStrategy’s bold bet on the digital currency has positioned the company as a trailblazer in the evolving world of cryptocurrency investments.

Leave a Reply