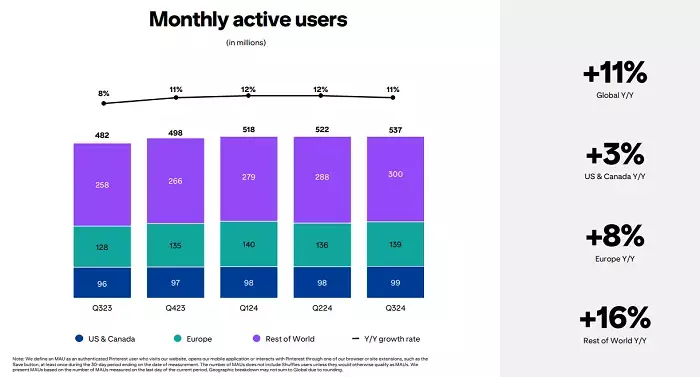

Pinterest has recently revealed impressive statistics regarding its performance, marking a significant peak in both revenue and user engagement. In the third quarter, the platform witnessed an addition of 15 million monthly active users (MAUs), bringing its total to 537 million. This uptick is especially noteworthy when compared to a mere 4 million new users added in the previous quarter, signifying a rejuvenation of growth momentum. Although the addition of 4 million users is by no means negligible, the recent surge reflects a more robust demand for the platform, hinting at effective engagement strategies and a potential shift in user perception.

The timing of this growth is critical, as Pinterest prepares for the holiday shopping season—a period traditionally marked by heightened consumer activity across various retail platforms. The record high in usage serves to enhance Pinterest’s positioning in the competitive landscape of e-commerce, particularly as retailers look to capitalize on digital shopping trends. Post-pandemic behavior has drastically altered how consumers engage with platforms like Pinterest, which was once buoyed by pandemic-driven online shopping surges, only to face a subsequent decline as physical stores reopened.

Pinterest’s journey following the COVID-19 pandemic has been tumultuous. Initially, the platform enjoyed a spike in user engagement as people sought inspiration for home decorating and meal planning while confined indoors. Analysts expected that this behavior would catalyze lasting changes in shopping habits. However, as brick-and-mortar stores reopened, the platform saw a decline in user engagement. Thankfully, recent data shows that Pinterest has not only recovered but now exceeds the levels observed during the pandemic. This shift denotes a successful pivot and a more stabilized foundation for future growth.

Despite this positive trajectory, one criticism arises: Pinterest’s growth has stagnated in key markets like the United States and the European Union (EU), which represent its primary revenue sources. While overall user engagement in these areas remains significant, the lack of new active users raises concerns about the impact this might have on advertising revenue and future profitability. Competing platforms are also facing saturation in these Western markets, compelling Pinterest to innovate and explore alternative avenues for ad revenue growth.

With expansion into emerging markets, Pinterest’s advertising business is seeing growth, albeit at a slower pace in the U.S. and EU. This situation places pressure on the company to devise inventive advertising solutions that can generate more revenue from a stable user base while keeping user experience intact. The risk of alienating users through excessive advertisement is ever-present, highlighting the delicate balance Pinterest must maintain.

The company’s average revenue per user (ARPU) continues to lag significantly in the EU compared to the U.S., presenting challenges in optimizing its ad strategy. Despite these hurdles, Pinterest should continue to expand its presence and advertising capabilities in untapped markets, as these areas may hold latent potential for enhancing revenue streams in the long run.

Pinterest reported revenue of $898 million for this quarter, which translates to an impressive 18% year-over-year growth. This solid financial performance is particularly promising as the company approaches the year-end shopping surge. With Q4 on the horizon, and last year’s figures providing a benchmark, Pinterest seems well-positioned for a successful finish in 2024. This upward trend is not merely a stroke of luck; it is the result of strategic enhancements in shopping functionality and digital recommendations, both of which are contributing to a more compelling user experience.

To further enhance user engagement, Pinterest has continued to roll out innovative features. Recent additions include AI-powered “Body Type Filters” that assist users in finding products that better match their body types, driving higher engagement and satisfaction. Moreover, the implementation of more AI elements in advertising has streamlined the ad creation process, aiding marketers in tapping into emerging trends. While these enhancements are crucial for long-term growth, they do come with increased costs—research and development expenditures have risen by nearly 25%. This investment is critical for ensuring that Pinterest remains competitive as other social platforms pour significant resources into AI.

The indicators for Pinterest are overwhelmingly positive, characterized by growth in user numbers, increased engagement, and a focus on innovative solutions to enhance user experience. As the company seeks to optimize its revenue potential internationally, particularly in regions outside the U.S. and EU, it must maintain a strong user-centric approach. By continuing to innovate and expand shopping options, Pinterest stands to solidify its reputation as a go-to destination for digital shopping. The journey to maximize ad opportunities while maintaining user satisfaction is a complex one, but Pinterest appears to be on the right path, aiming to align its strategic goals with user expectations in a rapidly evolving digital landscape.

Leave a Reply