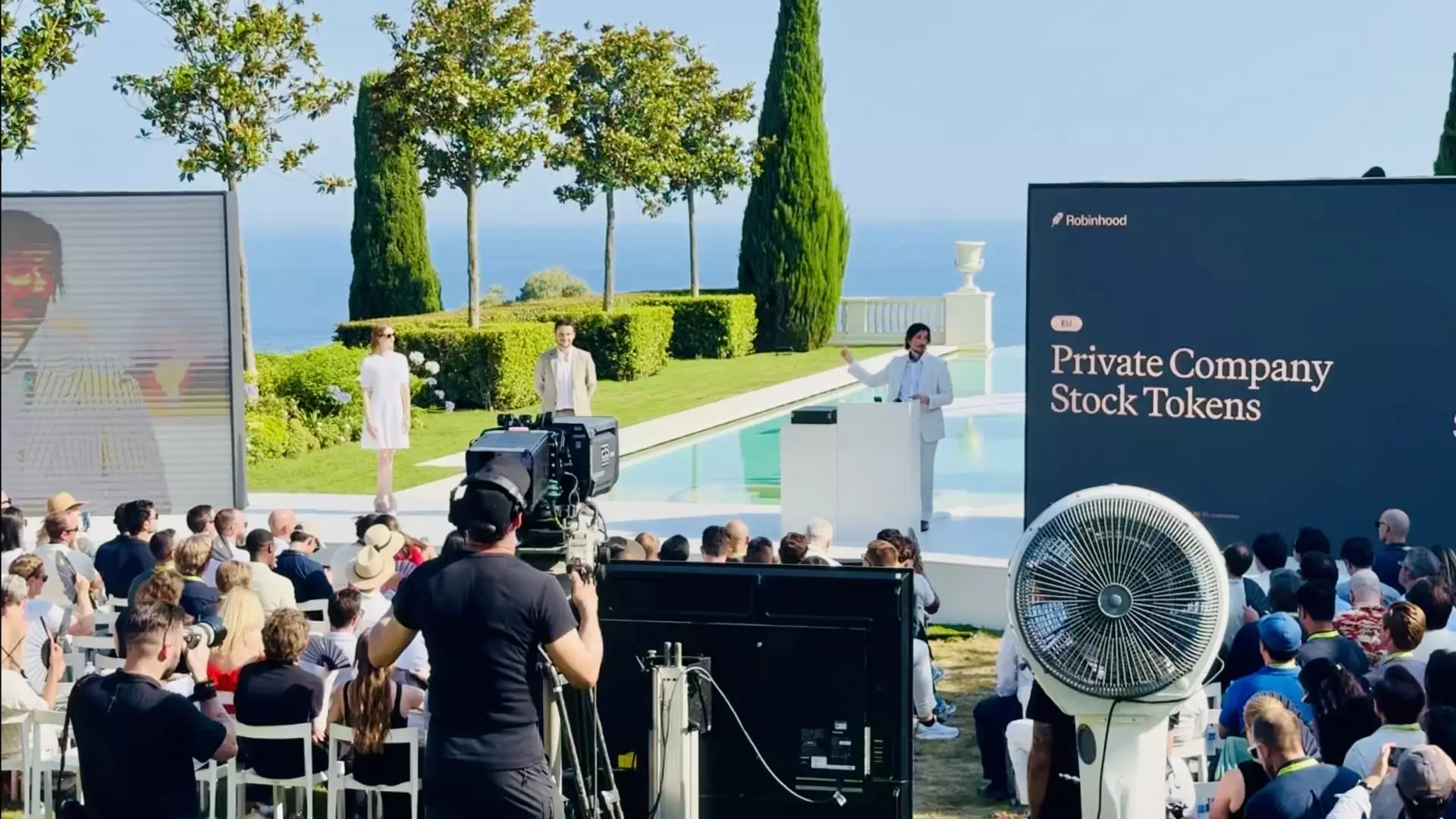

Robinhood’s recent move to introduce tokenized shares of private giants like OpenAI and SpaceX exclusively to European users marks a profound shift in how private equity might be accessed in the future. This initiative breaks the mold by democratizing investment opportunities that were historically confined to insiders and the ultra-rich. By leveraging blockchain technology, Robinhood is not merely expanding its crypto offerings but fundamentally challenging the traditional barriers that have long limited participation in private markets. The launch in Europe—facilitated by a regulatory environment more amenable to innovation—signals how regional policy frameworks can either hinder or accelerate the adoption of groundbreaking financial technologies.

A New Paradigm for Inclusion in Finance

Unlike conventional stock trading, Robinhood’s platform offers tokenized shares tradable 24/5 without commissions or spreads, effectively lowering transaction costs and increasing user accessibility. The decision to tokenize private company shares is particularly revolutionary because these companies have remained inaccessible to most retail investors due to legal and financial constraints. Robinhood’s approach tackles financial inequality head-on, a vision articulated by Johann Kerbrat, the company’s SVP of Crypto, who emphasized reducing the “inequality between people who’ve historically had access” and everyday investors. There is an implicit social justice thread woven into Robinhood’s strategy, aiming to foster inclusivity by enabling “anyone” to participate in companies previously perceived as off-limits.

Regulatory Realities Shape Innovation’s Trajectory

The divergence between Europe and the United States in this rollout highlights the critical role regulatory frameworks play in shaping financial innovation. While the European Union’s relaxed rules—specifically the lack of “accredited investor” restrictions—have empowered Robinhood to launch this tokenized stock product, similar offerings remain stifled in the U.S. market. This regulatory barrier underscores a broader systemic friction where outdated financial regulations struggle to keep pace with rapid technological advancements. Robinhood’s CEO, Vlad Tenev, has openly criticized this regulatory rigidity, advocating for reforms that could unlock private equity markets to a wider demographic. Until such changes occur, the U.S. will likely remain behind Europe in the race to mainstream tokenized private equity.

Integrating Blockchain Infrastructure for Future Growth

Beyond tokenized shares, Robinhood’s rollout includes the deployment of a Layer 2 blockchain solution built on Arbitrum, underscoring the company’s commitment to scalable and efficient crypto infrastructure. This technological backbone is essential not only for facilitating seamless token trading but also for expanding Robinhood’s broader vision of a decentralized financial ecosystem. It’s a savvy strategic move, aligning Robinhood with cutting-edge blockchain technology at a time when competition in crypto trading platforms is intensifying globally.

The U.S. Market: Staking Revival Amidst Regulatory Challenges

While the tokenized shares of private companies remain out of reach for U.S. investors, Robinhood has simultaneously reintroduced yield-generating crypto products like Ethereum and Solana staking stateside, a function previously hindered by SEC intervention. This subtle shift suggests Robinhood is navigating regulatory hurdles by focusing on incremental crypto offerings where compliance is feasible. The revival of staking products may signal an evolving regulatory stance or at least a calculated gamble by Robinhood to position itself as a frontrunner in crypto yield products in the U.S. Despite the barriers, such moves reflect Robinhood’s intention to steadily broaden cryptocurrency access and create diversified paths for user engagement and value creation.

Robinhood’s Vision: Democratizing the Future of Investment

By initiating tokenized private equity in Europe and expanding crypto product offerings across regions, Robinhood is clearly pursuing an agenda that goes beyond mere market share or short-term gains. It envisions a financial future where blockchain dissolves elitist investment thresholds and traditional gatekeepers lose their grip, making financial markets more inclusive and dynamic. This ambition is bold and necessary, but it also hinges on the delicate balance of embracing innovation while navigating complex regulatory environments. Robinhood’s journey illustrates the challenges and possibilities inherent in reshaping finance for the digital age—an endeavor as promising as it is complex.

Leave a Reply