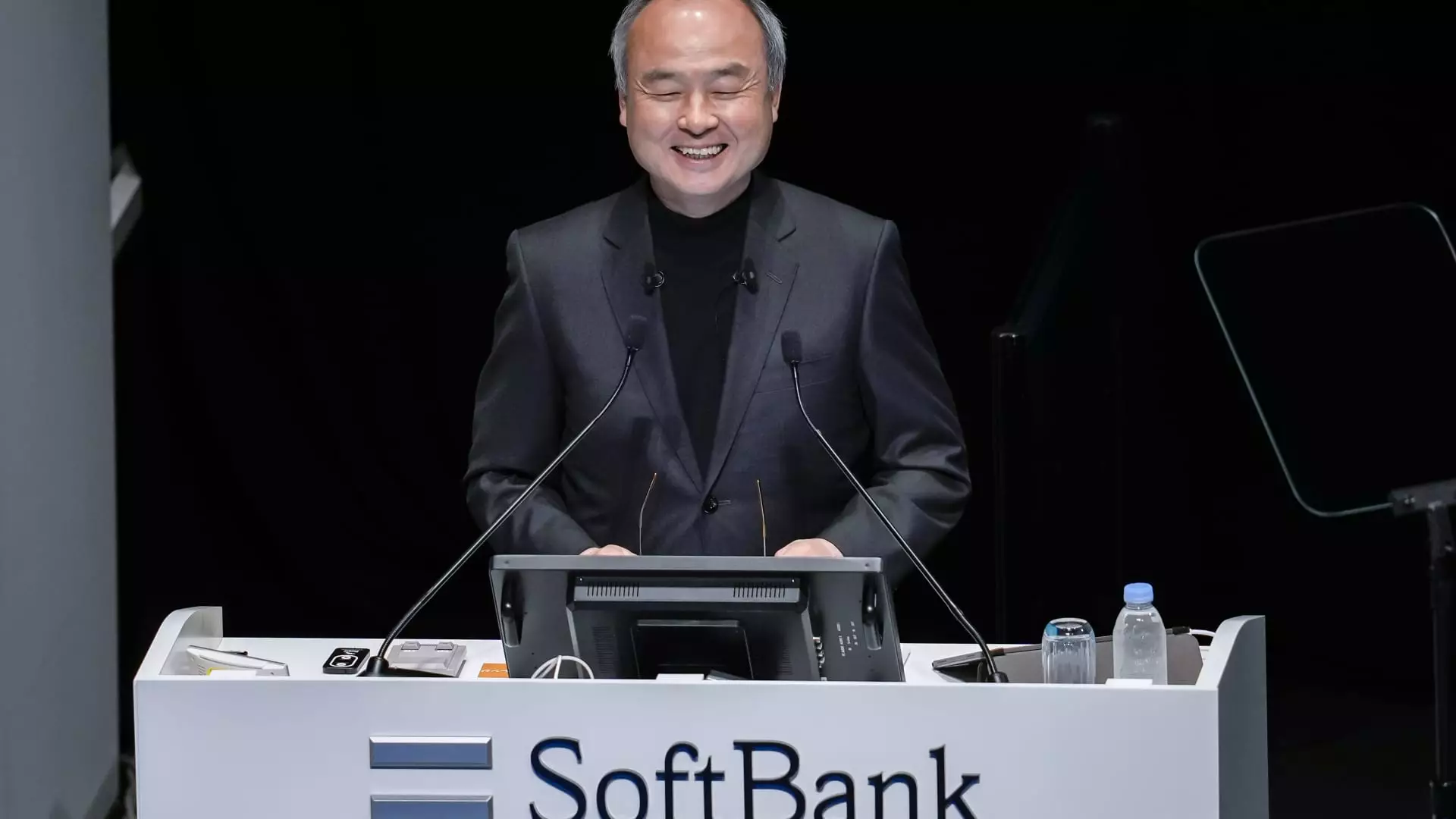

SoftBank’s CEO Masayoshi Son has long been renowned for his audacious investment strategies. Yet his unwavering commitment to OpenAI represents perhaps his most ambitious bet to date. While many investors hesitate to pour capital into unprofitable, privately held startups, Son’s firm is doubling down on OpenAI with a staggering $33.2 billion pledge. This isn’t just a financial maneuver; it signals SoftBank’s desire to shape the future of artificial intelligence on an unprecedented scale. Son’s goal transcends typical AI capabilities—he envisions spearheading the arrival of “artificial superintelligence” (ASI), a form of intelligence that surpasses human cognitive abilities by a factor of 10,000.

This strategy reveals both remarkable foresight and undeniable risk. The pursuit of ASI is often treated with scientific skepticism and ethical concern, yet SoftBank embraces it as the next industrial revolution. Son’s approach is not merely speculative dreaming; instead, he positions SoftBank as the central architect and platform for this emerging AI era, aiming to orchestrate a global ecosystem around ASI.

The Shifting Sands of OpenAI’s Alliances

SoftBank’s aggressive positioning comes in the context of OpenAI’s evolving partnerships. Microsoft, initially selected as the primary investor and provider of computing infrastructure, played a crucial role in OpenAI’s rise. However, recent developments indicate tension in that relationship. Microsoft’s resistance to OpenAI’s restructuring plan—intended to transition the company into a traditional profit-driven enterprise—highlights a growing misalignment of visions.

Son openly criticized OpenAI’s decision to partner with Microsoft instead of SoftBank earlier, hinting that SoftBank would have been a more aligned collaborator. Yet he acknowledged Microsoft’s extensive resources and brand helped OpenAI scale rapidly. Regardless of the ongoing challenges between Microsoft and OpenAI, Son’s commitment remains undeterred. SoftBank seems poised to intensify its involvement, signaling a remarkable determination to secure a leadership position in AI despite the complex political and corporate maneuvering surrounding OpenAI.

Strategic Synergies: Beyond OpenAI

What sets SoftBank’s ambitions apart is the holistic infrastructure plan Son is crafting. The strategy extends well beyond simply financing AI research. It involves integrating critical technologies and intellectual property spanning semiconductor innovation, cloud computing, and AI platforms. The acquisition of British chip designer Arm in 2016 and the recent $6.5 billion purchase of U.S. chipmaker Ampere are not ancillary moves—they are essential cogs in SoftBank’s grand design.

By controlling Arm, a foundational player in semiconductor architecture, and Ampere, a cloud hardware innovator, SoftBank builds a vertically integrated AI powerhouse. This integration offers tremendous leverage to accelerate the development and deployment of artificial superintelligence by combining hardware expertise with software prowess from OpenAI. Moreover, SoftBank is reportedly exploring massive industrial-scale initiatives, including a potential $1 trillion U.S. industrial complex—underscoring the scale of Son’s commitment.

Risk and Reward in the ASI Era

Son’s full-throttle investment approach embodies a high-risk, high-reward philosophy uncommon among traditional institutional investors. Betting billions on a still-unlisted, unprofitable company reflects extraordinary confidence rooted partly in the cultural and strategic vision of SoftBank. It is a conviction that the future belongs to those who master AI’s next frontier—artificial superintelligence.

However, this grand vision is not without pitfalls. The scientific community remains cautious about ASI’s feasibility and safety. Ethical concerns and regulatory challenges loom large. SoftBank’s pursuit might accelerate innovation but could also precipitate unforeseen consequences if the technology outpaces oversight and control measures. Moreover, navigating partnerships becomes more complicated if foundational alliances, like that with Microsoft, falter.

Still, Son’s willingness to embrace these risks puts SoftBank on a unique trajectory. He personifies a rare breed of leader unafraid to channel vast resources into a transformative, albeit uncertain, future. In doing so, SoftBank places itself not merely as a passive investor but as the emerging orchestrator of the AI revolution poised to redefine global industries—and perhaps humanity itself.

Leave a Reply