Artificial intelligence (AI) has emerged as a promising solution for complex modeling problems in various industries. One such area is risk management in investment banking, where AI’s potential to handle derivative contracts has been explored. However, while there have been positive reports, questions remain about the practical applicability of AI in this domain. A recent study published in The Journal of Finance and Data Science by a team of researchers from Switzerland and the U.S. delved into the use of reinforcement learning (RL) agents to hedge derivative contracts.

An essential aspect of training AI models is having sufficient and accurate data. The researchers in this study acknowledged the lack of training data for derivative markets, making it challenging to train RL agents effectively. They highlight the reliance on simulated market data, which can lead to the AI performing well only in situations that mirror the simulation. Additionally, the data consumption of many AI systems has been deemed excessive. These factors raise concerns about the real-life applicability of AI-based risk management solutions.

To compensate for the lack of training data, researchers often resort to using market simulators. However, this introduces another challenge: selecting the right model for simulation and calibrating it. The researchers liken this problem to classical financial engineering, where practitioners must carefully choose a model to simulate from. Furthermore, this approach aligns AI-based methods with traditional Monte Carlo methods used for many years. Consequently, using AI in this context does not necessarily imply being model-free, as sufficient real market data for training is rarely available in realistic derivative markets.

The study conducted by the collaboration between IDSIA and UBS focused on a technique called Deep Contextual Bandits. This approach is known for its data-efficiency and robustness in reinforcement learning. Notably, it was designed to address the operational complexities in real-world investment firms. It takes into account end-of-day reporting requirements, which are crucial for risk management. Furthermore, compared to conventional models, Deep Contextual Bandits require significantly less training data and can adapt to changing market conditions more efficiently.

The senior author of the study, Oleg Szehr, emphasizes that the availability of data and the operational realities of investment firms shape the actual work carried out in risk management. Instead of ideal agent training, the focus is on meeting reporting requirements and effectively managing risks. The newly developed model aligns with this practical perspective, mirroring the operations of investment firms. Thus, it offers a conceptual resemblance to real-world business operations, making it more applicable in practice.

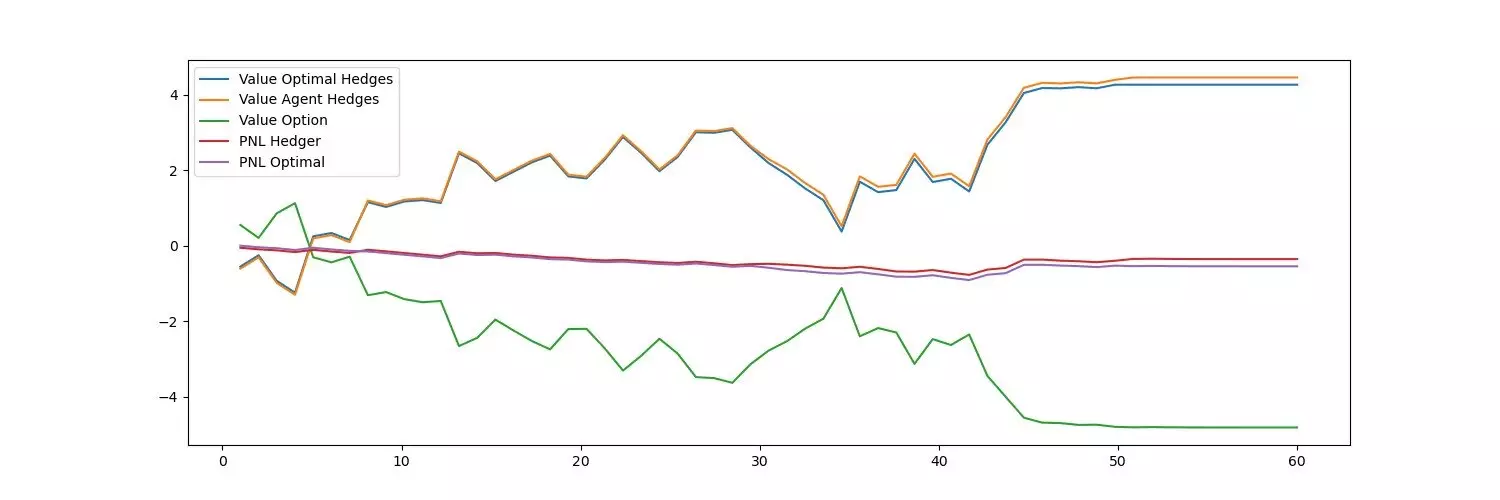

Despite its simplicity, the new model showcased superior performance when compared to benchmark systems. Rigorous assessments highlighted its efficiency, adaptability, and accuracy under realistic conditions. The study demonstrates that in certain situations, less complexity can lead to better risk management outcomes. This finding challenges the notion that AI solutions need to be intricate to be effective in risk management.

The use of AI in risk management, particularly for derivative contracts, presents both challenges and advantages. While the lack of training data and the reliance on simulated market data can limit the applicability of AI solutions, techniques such as Deep Contextual Bandits offer promising alternatives. By aligning with real-world operational requirements and offering better efficiency, adaptability, and accuracy, the newly developed model proves that simplicity can sometimes outperform complexity. As AI continues to advance, finding the right balance between complexity and practicality will be crucial in leveraging its full potential in risk management.

Leave a Reply