Snap Inc.’s latest performance update brings a mixed bag of results. While the platform has experienced an increase in users, the growth is not concentrated in its most profitable markets. Additionally, the company’s revenue has seen an increase, but it falls short of expectations.

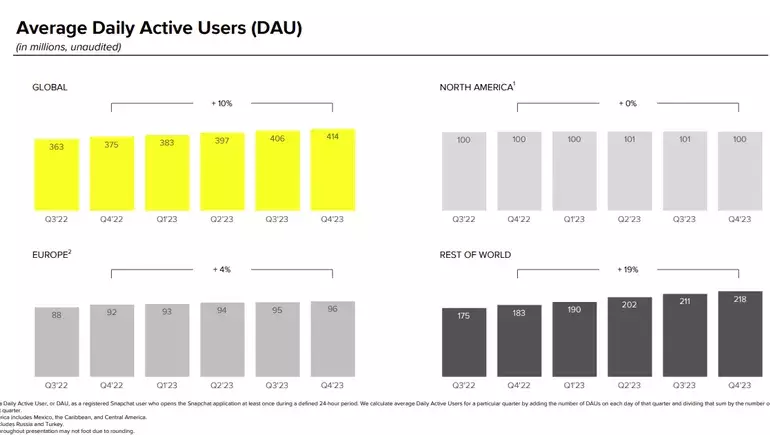

Snapchat’s daily active users (DAU) reached 414 million in Q4, showing a positive 10% year-over-year (YoY) growth. However, it is concerning that the platform lost one million users in North America, especially during the holiday season. The majority of Snap’s growth has come from the “Rest of the World” segment, which has been a recurring theme over the past year.

Recognizing this trend, Snap now plans to shift its focus towards community growth in more mature markets like North America and Europe. Previously, the company had been investing heavily in emerging markets, including India, to achieve growth. However, it no longer considers these markets as the primary target for user acquisition.

Snap recently launched an ad campaign in North America, portraying itself as “the antidote to social media.” It remains to be seen whether this approach will attract more users to the app and offset the decline in its key revenue markets.

In terms of user engagement, Snap reports a significant increase in time spent watching its TikTok-like Spotlight feed, with a YoY growth of over 175%. The average monthly active users on Spotlight have also risen by more than 35% YoY. This uptick is in line with the broader popularity of short-form video content. Notably, Snap has discontinued funding for its Snap Originals programming, indicating a shift in focus towards working with popular creators and user-generated content.

Augmented Reality (AR) remains a crucial area of opportunity for Snap. The platform boasts over 350,000 creators and developers who have built nearly 3.5 million AR Lenses for the app. On a daily basis, approximately 300 million Snapchatters engage with AR. Expanding business offerings in AR could play a pivotal role in Snap’s future.

However, Snap faced a setback when it shut down its third-party AR development platform, ARES, as part of its cost-cutting measures. Balancing revenue generation and cost reduction has become a challenge for the company, hindering its overall progress.

Snap’s revenue for the quarter was $1.36 billion, a 5% YoY increase. While this growth aligns with prevailing market conditions, it falls short of market expectations. A major concern for Snap is its struggle to expand its audience in key revenue markets, resulting in relatively flat usage rates in North America and Europe.

When examining Snap’s average revenue per user, it becomes evident that the “Rest of the World” category, where most of the growth occurs, has lower revenue per user. Furthermore, this revenue has declined over the past year. Thus, despite audience expansion and potential future opportunities, Snap’s current market potential is not growing at an optimal rate, indicating potential flaws in its evolving business plan.

CNBC reports that this performance update marks six consecutive quarters of single-digit growth or decline at Snap. While the platform’s user base continues to grow, reaching 414 million active users and counting, it still fails to resonate beyond its core demographic and attract users above the age of 30. Snap has made efforts to address this issue, but the app remains niche and is overshadowed by other major social media platforms. This limitation also reduces Snap’s business potential as fewer brands seek to reach this specific market.

Snap’s opportunities appear limited, especially considering its AR ambitions have been hindered by cost-cutting measures and lay-offs. Rivals such as Apple and Meta are gaining momentum in the AR space, backed by significant resources, making it difficult for Snap to compete and regain its leadership position.

While Snap’s CEO, Evan Spiegel, emphasizes the company’s focus on AR despite cost-cutting measures, he has criticized the metaverse push from Meta, which he sees as the next stage of digital connectivity. These internal contradictions within Snap reflect its complex and challenging situation, balancing strengths and weaknesses as it struggles to find a solid market balance.

Snap remains a vital connector for users and a critical tool for teenage connections. However, investors may view Snap as less valuable until the company restores revenue growth to a stable trajectory.

Leave a Reply