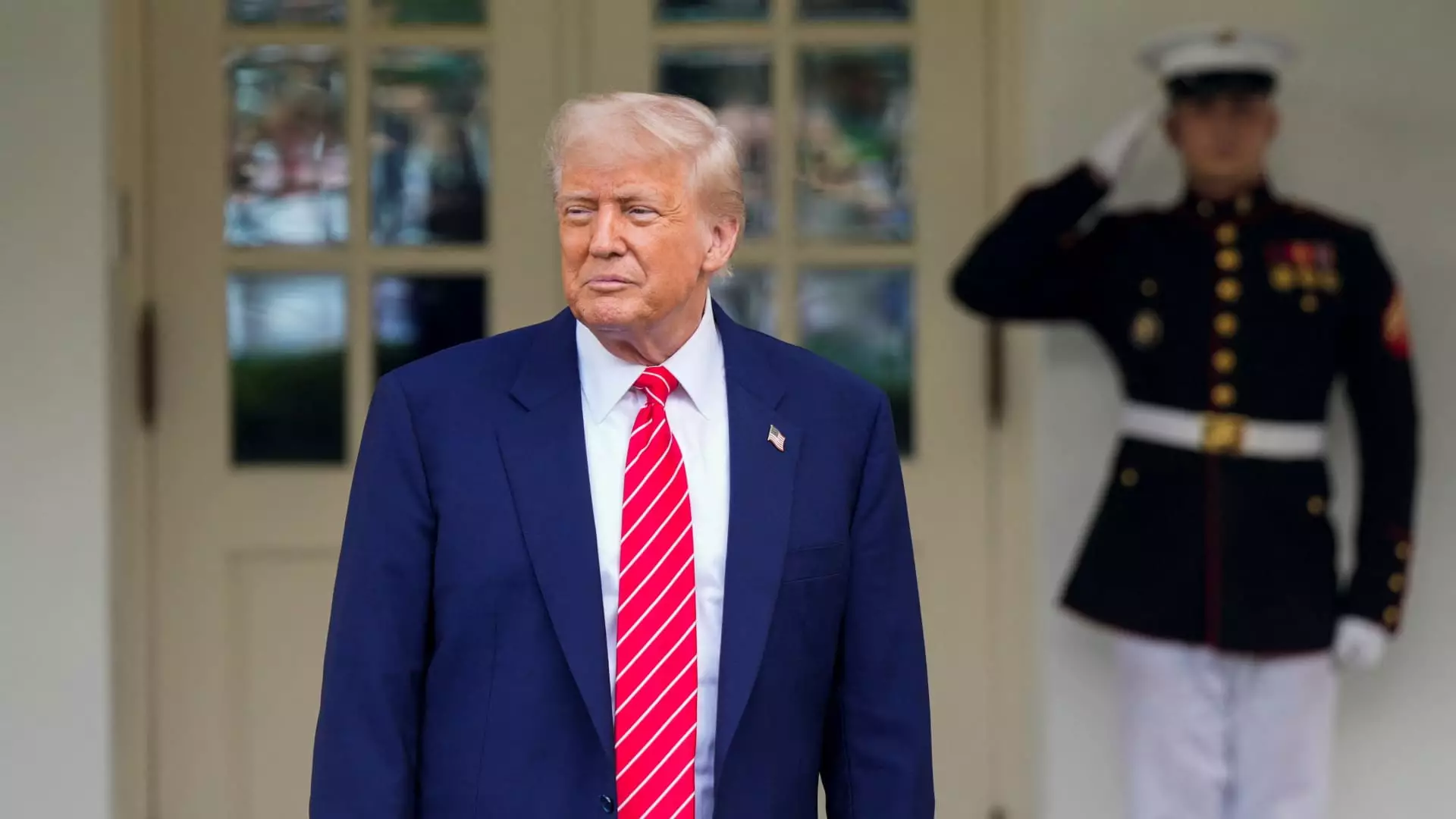

The recent failure to pass the GENIUS Act, a comprehensive framework intended to regulate stablecoins at the federal level, underscores the intricate web of politics and personal interests that enshrouds the cryptocurrency landscape in the United States. The act aimed to establish essential guidelines for digital currencies pegged to assets like the U.S. dollar but was thwarted in the Senate, largely due to the perceived conflicts of interest tied to President Donald Trump’s personal cryptocurrency holdings. This incident exemplifies a larger narrative where personal gain fundamentally clashes with legislative progress.

Senator Jeff Merkley of Oregon has emerged as one of the leading voices against the GENIUS Act, citing the president’s crypto ventures as a motive for corruption that further complicates national security. He articulated a concerning reality: individuals may seek to curry favor with the president by purchasing cryptocurrencies that he owns. Such a situation not only raises questions about public trust in government institutions but also destabilizes the regulatory environment necessary for a flourishing digital economy. The implications of this scenario paint a disturbing picture of a political landscape where financial interests supersede the public good.

Republican Dilemma: The Fight for Legislative Success

For Republicans, the task of moving legislation through Congress can feel insurmountable, especially given their slim majority in the House and the persistent filibuster challenges in the Senate. At what should have been a pivotal moment for bipartisan success, the narrative shifted from uniting for regulatory advancement to battling the implications of a president’s financial entanglements. With a significant portion of Senate Democrats united against Trump, the potential for a collaborative effort on stablecoin regulation devolved into partisan conflict.

The push for the GENIUS Act initially gathered traction as it promised a chance for bipartisan consensus. However, the situation became complicated when several Democrats shifted their support away from the bill, pointing fingers at Trump’s personal financial interests as a deterrent to responsible legislation. Their demand for more rigorous provisions related to anti-money laundering and national security compounded the legislative stagnation, exemplifying how divergent priorities can derail critical policy initiatives.

The Rise of Conflict and Critique

Trump’s foray into the cryptocurrency market, highlighted by the launch of his meme coin—a digital asset that has gained substantial value through promotional events—compounds the stakes for legislators. Critics view this as a blatant “pay-for-play” scheme, further muddying the waters of ethics in governance. For instance, the First Lady, Melania Trump, has also entered the crypto space, with her coin contributing to skeptics’ concerns surrounding the integrity of elected officials.

Senator Richard Blumenthal’s indignation directed at the president’s penchant for profit aligns with a broader critique by multiple lawmakers. The implications of these personal ventures extend far beyond the realm of public relations; they provoke legitimate concerns about the overall integrity of the legislative process. The mere existence of Trump’s familial business endeavors casts a shadow over any potential policy aimed at regulating cryptocurrencies effectively and transparently.

Impact on Future Legislation and the Crypto Industry

For stakeholders in the cryptocurrency sphere—including investors and innovators—Trump’s private business interests have become a salient barrier on the path toward legislative clarity. In an industry desperately seeking stability and credibility, the impact of such contradictions is profound. As Ryan Gilbert of Launchpad Capital remarked, the entanglement of personal filing with policy creation is regrettable, hindering constructive progress meant to benefit the broader economy.

As discussions around crypto legislation continue, the overarching sentiment remains one of frustration. Senators like Elizabeth Warren and Kirsten Gillibrand have articulated the urgent need for regulatory frameworks that can bolster consumer protections while enhancing the viability of the U.S. crypto market. The discontent regarding the GENIUS Act’s failure reflects a broader disillusionment with how personal financial pursuits can interfere with critical policy-making, shifting the focus from innovation to in-fighting.

The cyclical nature of conflict stands as a glaring indictment of the politicized cryptocurrency landscape. As legislative attempts falter, the potential for the U.S. to emerge as a leader in the global crypto industry wanes. Gilbert’s assessment—that such entangled interests could render the U.S. a “laughingstock” in the world of digital finance—serves as a sobering reminder of the price of political discord coupled with personal ambition, calling into question both the integrity and efficacy of governance moving forward.

Leave a Reply