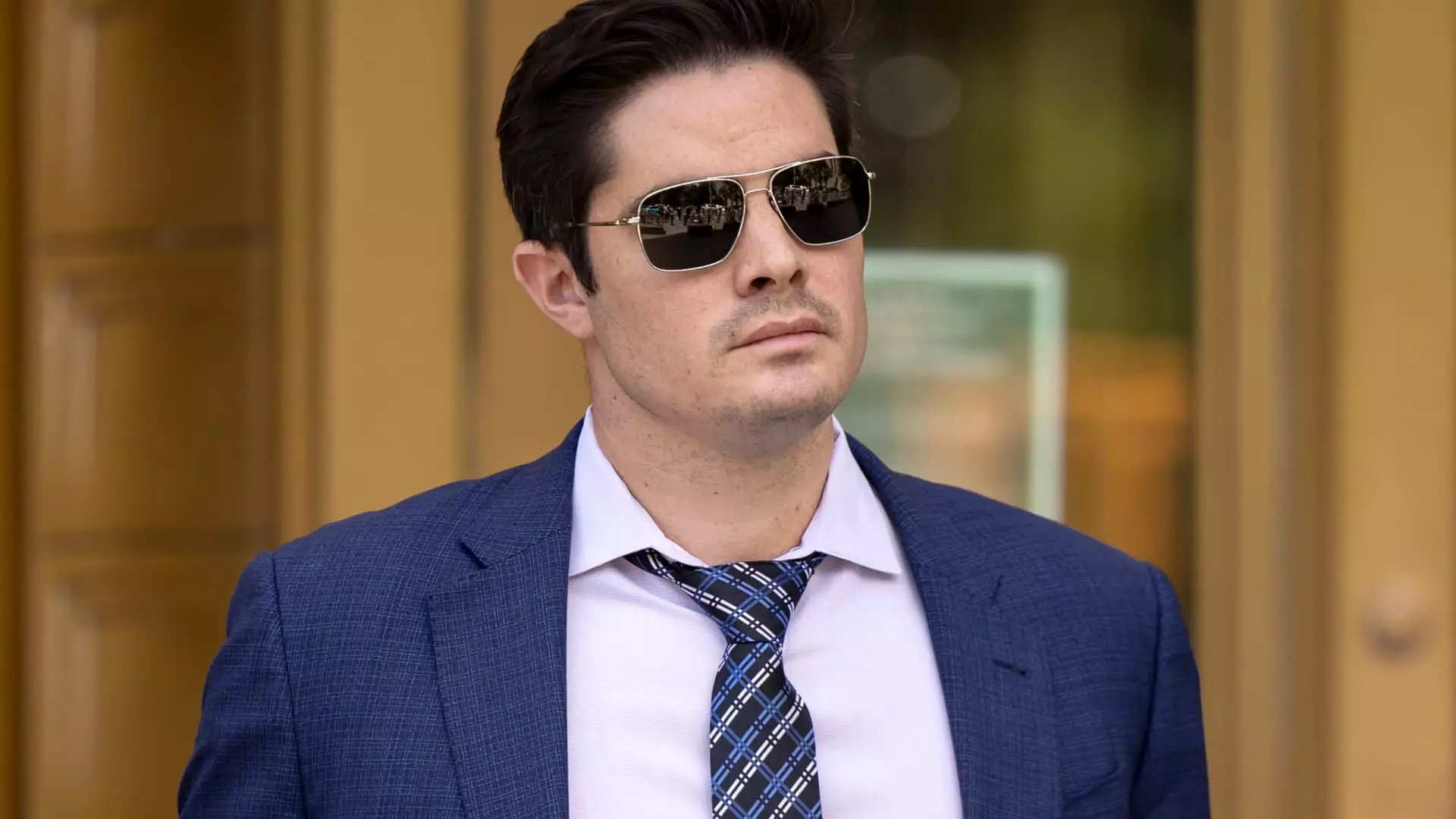

Ryan Salame, once a prominent figure in the world of cryptocurrency and finance as the former co-CEO of FTX’s Bahamian subsidiary, has been handed a hefty sentence of 90 months, or seven and a half years, in prison. This sentencing comes as a result of his guilty plea to charges of conspiracy to make unlawful political contributions, defraud the Federal Election Commission, and conspiracy to operate an unlicensed money-transmitting business. Despite prosecutors initially suggesting a lighter penalty of five to seven years, Salame’s actions have led to a more severe consequence, accompanied by three years of supervised release, over $6 million in forfeiture, and more than $5 million in restitution.

Salame’s journey from a position at Alameda Research, a renowned crypto hedge fund founded by Sam Bankman-Fried, to becoming a key player at FTX Digital Markets was marked by a series of financial misdeeds. During his tenure, he indulged in lavish spending, with one estimate suggesting that he, along with Bankman-Fried, spent a staggering $256.3 million on real estate across New Providence. This extravagant lifestyle was funded, in part, through questionable means, as evidenced by the charges of illegal contributions and money-transmitting activities.

The Revelation of Criminal Activities

The unraveling of Salame’s crimes began with his disclosure to Bahamian authorities regarding potential fraudulent activities orchestrated by Bankman-Fried. This revelation highlighted the mishandling of clients’ assets, casting a shadow of doubt over the integrity of the financial system. Subsequent testimonies from other insiders, including Alameda’s former CEO, SBF’s ex-girlfriend, and FTX’s co-founder, further solidified the case against Bankman-Fried, ultimately leading to his guilty verdict in November.

U.S. attorney Damian Williams emphasized the significance of Salame’s sentencing in restoring public trust in American elections and financial systems. By participating in unlawful activities that undermined the core principles of integrity and transparency, Salame has become the first member of SBF’s executive team to face the repercussions of their actions post the exchange’s declaration of bankruptcy. The implications of his sentencing serve as a stark warning to others within the industry, highlighting the substantial consequences awaiting those who choose to engage in fraudulent practices or criminal behavior.

The case of Ryan Salame sheds light on the far-reaching consequences of white-collar crime within the realm of finance and cryptocurrency. From the transition of power dynamics within top-tier companies to the erosion of public trust in critical institutions, the aftermath of Salame’s actions serves as a cautionary tale for individuals operating in similar spheres. As the legal system continues to crack down on financial malpractice, the need for accountability and adherence to ethical standards remains paramount in upholding the integrity of the financial landscape.

Leave a Reply