The landscape of venture capital (VC) in the United States is currently undergoing transformative changes, with numerous unicorns—startups valued at over $1 billion—expected to file for public offerings in 2025. A significant report by PitchBook, in conjunction with the National Venture Capital Association (NVCA), highlights these prospects and presents an intricate portrait of the current entrepreneurial ecosystem.

A pivotal tool at the heart of this analysis is PitchBook’s VC exit predictor, which utilizes machine learning algorithms to assess the likelihood of successful exits for startups. This tool draws upon an extensive database that includes details about funding rounds, investor behavior, and company performance metrics. Each VC-backed firm receives a probability score that indicates its chances of being acquired, going public, failing, or becoming self-sustaining. This approach offers a more nuanced understanding of the VC landscape, moving beyond mere speculation to informed projections.

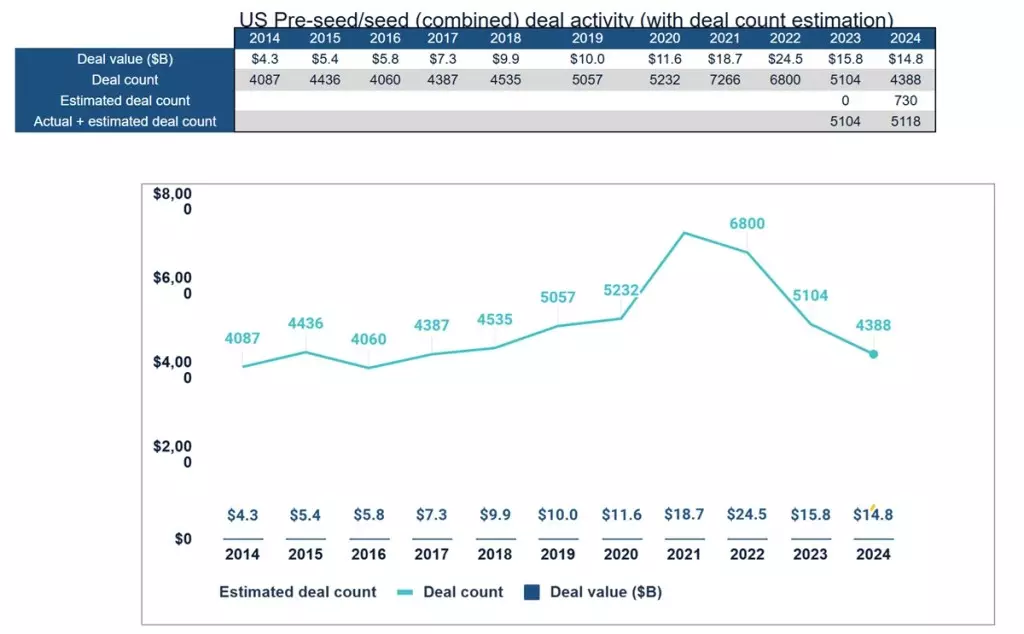

Interestingly, the report reveals that while the number of financing rounds and overall investment amounts rose in 2024, this trend is marred by the realities of the venture industry. The findings indicate a disconnect between current valuations and practical exit opportunities, largely stemming from inflated funding rounds in previous years. As a result, the market is witnessing a significant contrast between thriving early-stage, AI-driven startups and a broader sector that still grapples with economic corrective measures.

Nizar Tarhuni, the EVP of Research and Market Intelligence at PitchBook, captures the potential juxtaposition of optimism and caution that VCs and startups face as they approach 2025. He points out that the absence of substantial exit activity remains a pressing concern, exacerbated by mismatches in buyer-seller valuations and existing regulatory restrictions. However, Tarhuni also expresses a level of cautionary optimism, suggesting that a more favorable regulatory environment and an adjustment in expectations for startups and investors post-2024 could stimulate investment activity.

Bobby Franklin, CEO of the NVCA, echoes this sentiment, noting a slight resurgence in investment levels and a cautiously optimistic outlook for the coming year. Franklin highlights the importance of governmental support, evidenced by leadership changes in regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ), which could alleviate liquidity constraints for companies. Additionally, he emphasizes the chance for the venture industry to promote its own value in fostering economic growth and technological advancement.

Among the high-profile unicorns anticipated to go public in 2025, the report specifically identifies key players, such as Anduril, a defense startup founded by Oculus creator Palmer Luckey, and Mythical Games, known for its contributions to Web3 gaming. Both companies boast a staggering 97% probability of a successful IPO in 2025. Joining them are firms like Impossible Foods and SpaceX, with their own impressive IPO likelihoods. Such predictions showcase not only the innovative capacity of these startups but also reveal the sectors that are currently thriving and attracting investor interest.

Nonetheless, beneath the anticipation of these IPOs lies a broader reality of the VC funding landscape. Data indicates a decrease in the number of startups securing funding within the $1 million to $5 million range, signaling a contraction from previous years. This reduction in deal count alongside the increased valuation pressures reflects the tense environment startups must navigate.

The path forward for U.S. unicorns remains a blend of uncertainty and promise. While optimism abounds regarding upcoming IPOs and a potential recovery in investment enthusiasm, systemic challenges linger. The continued evolution of the startup ecosystem will depend significantly on the interplay between regulatory conditions, valuation adjustments, and the agility of founders to adapt to a shifting market landscape. As 2025 looms closer, the ability of these companies to leverage their unique innovations may ultimately dictate their success in public markets, defining the next chapter in the journey of U.S. venture capital.

Leave a Reply