Grabango, a startup that emerged in 2016, positioned itself at the forefront of the cashierless checkout revolution. Founded by Will Glaser, a seasoned Silicon Valley entrepreneur known for co-founding Pandora, Grabango aimed to challenge the dominance of tech behemoth Amazon in the rapidly evolving domain of shopping convenience. The ambition was bold, focusing on harnessing computer vision and machine learning to eliminate traditional payment lines in grocery stores. However, in a surprising twist that echoes the age-old fable of the Tortoise and the Hare, Grabango has unexpectedly ceased operations, raising pivotal questions about innovation, market dynamics, and the sustainability of tech startups.

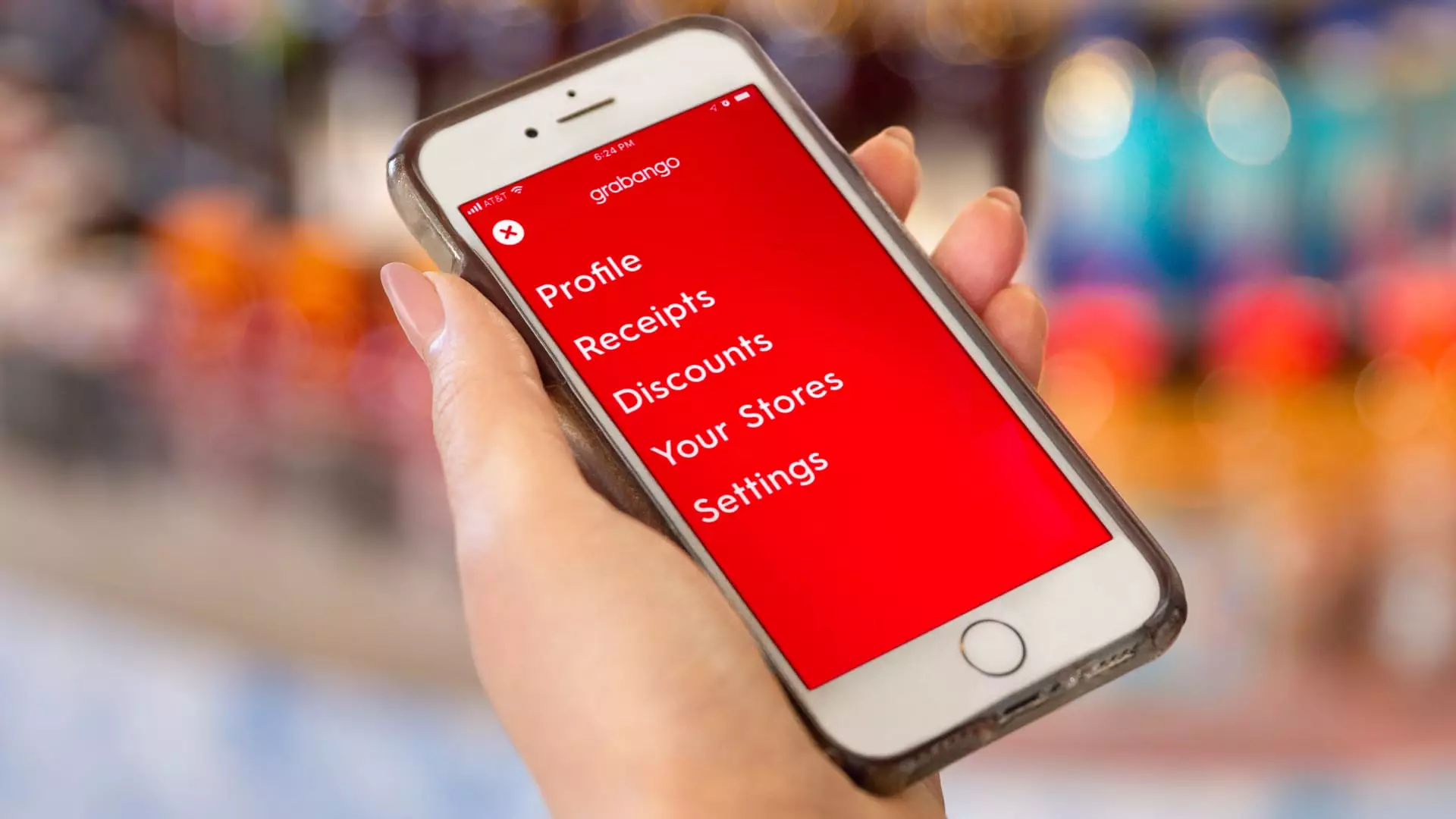

Initially, Grabango captured attention with its cutting-edge technology, which allowed consumers to shop freely without the conventional burden of waiting in lines or handling cash and cards. This innovation inspired hope for a more efficient shopping experience, leading to partnerships with prominent retailers such as Aldi and 7-Eleven. The startup’s vision promised a redefinition of retail experiences, attracting approximately $73 million in funding, with significant investments from notable venture capitalists and industry giants. However, the ambitious plans began to unravel as the market dynamics shifted.

As Grabango aimed to scale its operations, it encountered significant hurdles. The company’s most considerable funding injection occurred in 2021, a year marked by optimistic projections for tech IPOs (Initial Public Offerings). Glaser himself projected a future public valuation as high as $15 billion. But the reality proved starkly different: the IPO landscape has been fraught with challenges since early 2022, constraining venture capital availability across the board. This change signaled trouble not just for Grabango, but for startups reliant on continuous funding to innovate and grow.

The drying up of capital markets has had a toll on many startup ecosystems. Grabango, with its soaring ambitions, faced insurmountable pressure to secure additional funding. Unfortunately, as the company’s spokesperson confirmed, it could not raise sufficient capital to maintain its operations. The inability to pivot or secure adequate financial backing ultimately led the company to announce its closure, reflecting a harsh reality for many tech enterprises.

Grabango’s journey stands as a stark reminder of the competitive landscape within the cashierless space, which primarily pits them against the likes of Amazon and other startups such as AiFi and Trigo. Amazon’s Just Walk Out technology has set a high bar for innovation and customer adoption. Interestingly, despite Amazon’s early lead, its cashierless solutions also faced challenges, such as a recent retraction from U.S. Fresh stores. These strategic moves may reveal weaknesses in what was initially deemed a robust technology.

In contrast to Amazon’s approach, Grabango’s reliance on computer vision over shelf sensors was a strategic decision intended to foster broader implementation. Glaser’s assertion pointed to the potential for wider adoption despite the setbacks. However, the commitment to an alternative technology path could not shield Grabango from the volatility impacting the industry, as evidenced by its operational closure.

The closure of Grabango serves as an illustrative case within the broader narrative of technological entrepreneurship—a cautionary tale merging ambition with market realities. It highlights the precarious balancing act that startups must maintain between innovation and sustainable business practices.

Ultimately, the fate of Grabango underscores that revolutionary ideas may not be enough to ensure success if they are not coupled with prudent financial management and market-responsive strategies. For emerging tech in the checkout space, the future remains a mixed bag of sprawling opportunity and equally substantial risk. As notable players reevaluate their strategies in this evolving landscape, the closing chapter of Grabango may inspire future innovators to tread carefully in their pursuit of disruptive technologies. The retail world continues to shift, and the next wave of innovation is poised to emerge—hopefully, with lessons from the past firmly in place.

Leave a Reply