Uber Technologies, Inc. recently unveiled its fourth-quarter performance, revealing a complicated economic picture that reflects both robust growth in revenue and cautious guidance for the upcoming quarter. Despite achieving better-than-expected earnings, shareholders reacted negatively, driving down the company’s stock by approximately 7% in premarket trading following the announcement. This paradox of strong revenue growth coupled with a subdued outlook has left analysts and investors pondering the sustainability of Uber’s momentum.

In the fourth quarter, Uber reported earnings per share (EPS) of $3.21, significantly surpassing the anticipated expectation of 50 cents as forecasted by LSEG. Revenues reached $11.96 billion, up from $9.9 billion the previous year, illustrating a sturdy 20% year-over-year growth and slightly exceeding the $11.77 billion projection by financial analysts. However, a closer inspection of the numbers reveals that a substantial portion of this net income—$6.4 billion—stemmed from a tax benefit, while an additional $556 million came from gains related to equity investments. This raises questions about the sustainability of Uber’s profitability, suggesting that its core operations may not be as robust as the headline figures indicate.

The highlighted gross bookings for the quarter stood at $44.2 billion, outperforming analyst expectations of $43.49 billion, indicating a strong demand for Uber’s services. Furthermore, the adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $1.84 billion matched forecasts but masked potential challenges ahead. The company’s guidance for the first quarter projected gross bookings in the range of $42 billion to $43.5 billion, below the consensus estimates of $43.51 billion. This more conservative outlook, alongside anticipated adjusted EBITDA of $1.79 billion to $1.89 billion, further fueled investor skepticism about future growth trajectories.

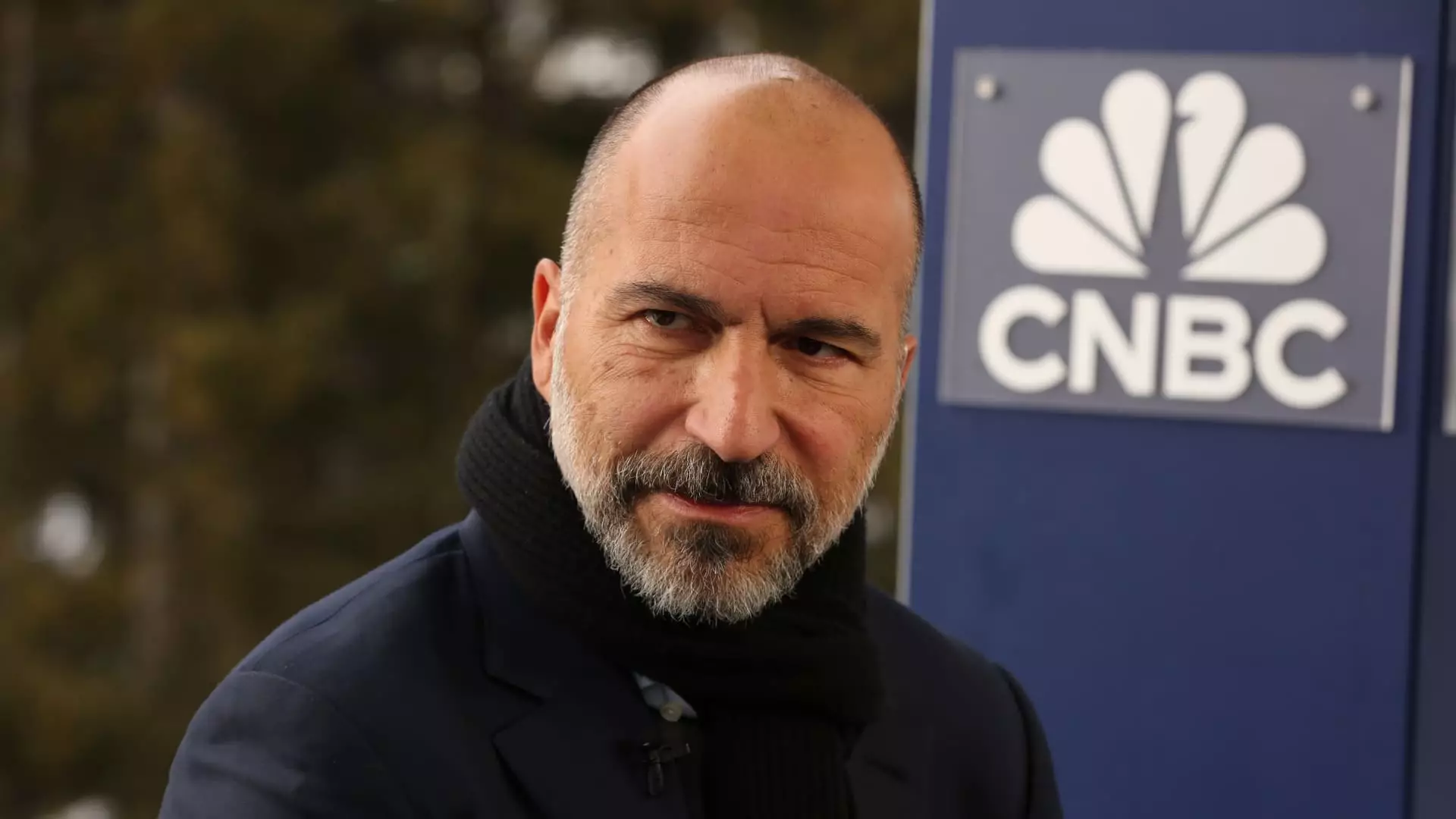

Amidst the backdrop of these financial results, Uber’s CEO, Dara Khosrowshahi, underscored the company’s commitment to innovation, particularly regarding its foray into autonomous vehicles. The announcement of a partnership with Waymo to launch robotaxi services in Austin represents a significant step in this direction. Beginning that very day, eager consumers could enlist on an “interest list” through the Uber app, anticipating an autonomous ride experience. The strategic pivot highlights Uber’s recognition of evolving market dynamics and its determination to maintain a competitive edge in the increasingly crowded mobility landscape.

Moreover, operational growth metrics reflect positively on the consumer’s sentiment towards Uber’s services. The platform recorded an impressive 3.1 billion trips during the fourth quarter, up 18% year-over-year, while the number of monthly active users reached 171 million, a 14% increase from 150 million in the prior year. The performance of Uber’s core business segments—mobility and delivery—contributed to this surge, with gross bookings in the mobility sector rising to $22.8 billion and delivery bookings hitting $20.1 billion, both up 18% compared to the previous year. Notably, the mobility segment’s revenue also outpaced expectations, signaling continued consumer reliance on ride-hailing services.

On a less encouraging note, Uber’s freight business has exhibited stagnation, achieving revenues of $1.28 billion, which remained flat year-over-year and fell short of analysts’ expectations. This signals challenges in the logistics sector, driven by a post-pandemic shift in consumer spending habits favoring services over goods delivery. Khosrowshahi has acknowledged this trend, proposing that consumer preferences have significantly altered, thus negatively impacting Uber’s freight revenue.

The upcoming quarterly call with investors will undoubtedly offer insights into Uber’s strategic plans to navigate these hurdles and capitalize on the substantial opportunities presented by innovation. With the looming concerns over future profitability and scrutiny over the company’s operational leverage, the path ahead for Uber seems to be one of cautious optimism, entwined with strategic initiatives to bolster stakeholder confidence.

While Uber’s fourth-quarter results suggest strong momentum in specific areas, the mixed financial outcomes and cautious projections are telling. Investors and industry observers will need to stay tuned to see if Uber’s innovations and operational strategies can effectively remedy the challenges inherent in its freight segment and create sustained profitability in the quarters to come.

Leave a Reply