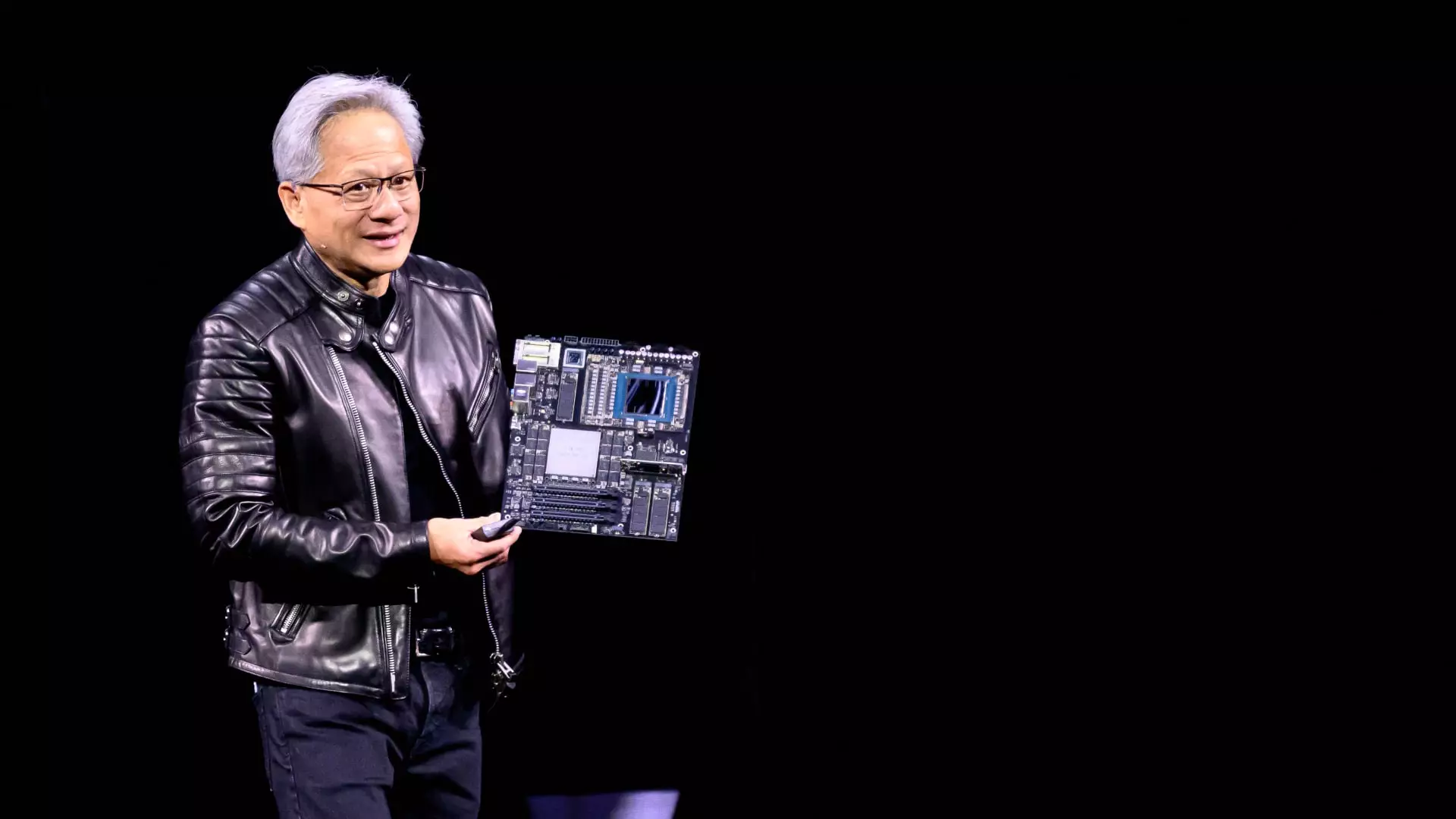

Jensen Huang, the charismatic CEO of Nvidia, recently captivated audiences during a two-hour keynote speech at Nvidia’s GTC conference. In a world increasingly driven by artificial intelligence, Huang delivered a powerful message: organizations should prioritize obtaining the fastest chips that Nvidia has to offer. His unscripted session highlighted not only the capabilities of these chips but also the larger vision for the future of AI technologies. This fervent push for speed and performance represents a considerable shift—not merely in hardware procurement but in how businesses can harness AI for transformative efficiencies.

It became clear that Huang recognizes the pressing need for rapid advancements in technology, particularly for hyperscale cloud providers such as Microsoft, Google, Amazon, and Oracle. In conversations with journalists after his keynote, he elaborated that the concerns surrounding the costs associated with AI-driven graphics processors would soon be mitigated by the sheer capability of faster chips. Huang’s confident assertion that “speed is the best cost-reduction system” encapsulates a pivotal philosophy that businesses must embrace: investing in cutting-edge technology can lead to unprecedented returns on investment.

Economics of Speed: Redefining Cost Structures

During his talk, Huang deftly tackled the economic realities that cloud operators face. He devoted ten minutes to explaining the cost-effectiveness of faster chips, breaking down the figures behind the cost-per-token metric that gauges the financial implications of AI outputs. This metric is of paramount importance for hyperscale cloud and AI companies as they seek to validate their investments. By sharing his own calculations, Huang aimed to dispel any uncertainty about the future of AI spending.

The unveiling of Nvidia’s Blackwell Ultra systems promises an exhilarating leap in performance. Described as being capable of generating fifty times the revenue of its predecessor, the Hopper systems, these new chips could revolutionize the way data centers operate. The implications of this innovation stretch far beyond theoretical capabilities; they underscore a fundamental transformation in AI economics. With acquisitions of 3.6 million Blackwell GPUs already underway, the environment is set for a technological renaissance, one where efficiency and profitability trend upward.

Building Tomorrow: The Strategic Roadmap Ahead

It’s apparent that Nvidia is not merely reactive to the marketplace; they are actively shaping it. Huang’s decision to pre-announce forthcoming innovations, such as the anticipated Rubin Next and Feynman AI chips planned for 2027 and 2028 respectively, speaks volumes about their foresight. By offering insight into their technology roadmap, Nvidia is enabling power players in the AI sphere to plan substantial investments in infrastructure accordingly. “Several hundred billion dollars of AI infrastructure” is on the cusp of realization, Huang emphasized, underscoring a seismic shift in investment that industry leaders are already preparing to embrace.

The challenge, however, lies in meeting these ambitious expectations. Huang’s insights about the hesitancy of companies to create custom chips brings an added layer of realism to the AI landscape. The assertion that many custom AI chips, known as ASICs, struggle for market entry reveals the inherent risks in technology development. Huang’s skepticism highlights an important truth in tech: the barrier to success is exceedingly high, and many attempts may falter in this session of rapid innovation.

A Competitive Edge: Nvidia’s Strategy in a Crowded Market

As Huang articulately mapped out the strengths of Nvidia’s offerings, he consistently reinforced the message that flexibility and performance are non-negotiable in this fast-paced environment. His dismissal of the competition—especially concerning custom chips—underscores Nvidia’s commitment to ensuring that their GPUs remain unrivaled in capability. The reality is that AI’s rapid evolution necessitates nimbleness, and Huang firmly believes that Nvidia’s solutions are uniquely positioned to dominate in this arena.

In a market where many businesses are enticed by the allure of cheaper, custom technologies, Huang’s insistence on superior performance and versatility presents a stark contrast. His declaration that “the ASIC still has to be better than the best” illustrates a core competency that concept-driven innovation often underestimates: real-world efficacy. Nvidia’s longstanding dedication to superior production quality sets them apart, signaling to investors and businesses alike that cutting corners will not yield sustainable success.

In sum, Jensen Huang’s fiery keynote not only showcased Nvidia’s technological prowess but also provided a bold blueprint for the future of AI. By intertwining economic rationale with cutting-edge innovation, Huang is not just making a case for their products; he’s driving a movement towards adopting the fastest, most efficient solutions available. The landscape of AI is rapidly transforming, and at the heart of this transformation is Nvidia—the frontrunner with a vision that empowers businesses to leap into the future with confidence and ambition.

Leave a Reply